Threshold has always believed that Bitcoin should move freely across financial markets without losing the principles that make it trusted and pristine. That belief has guided everything we’ve built so far. This time, we’re taking it a step further, expanding access to make Bitcoin participation broader and more inclusive. Our renewed focus is centered on being able to serve institutional participants while continuing to empower individual users through tBTC, the tokenized Bitcoin that connects liquidity across onchain markets with security, transparency, and scale.

And this is how we plan to execute on this promise.

Meet the new Threshold Network

Research-Backed Perspective: How Data Guided Threshold’s Institutional Strategy

Over several months, our team has delved deeply into Bitcoin data, studying not just price trends but also the broader patterns of ownership, liquidity, and behavior that define its place in global finance. From sprint sessions to comprehensive research into how Bitcoin capital moves, we examined the infrastructure gaps that prevent seamless participation across markets.

What we found was clear: as institutional demand grows and onchain activity expands, there is a need for infrastructure that upholds Bitcoin’s integrity while meeting the performance expectations of professional users.

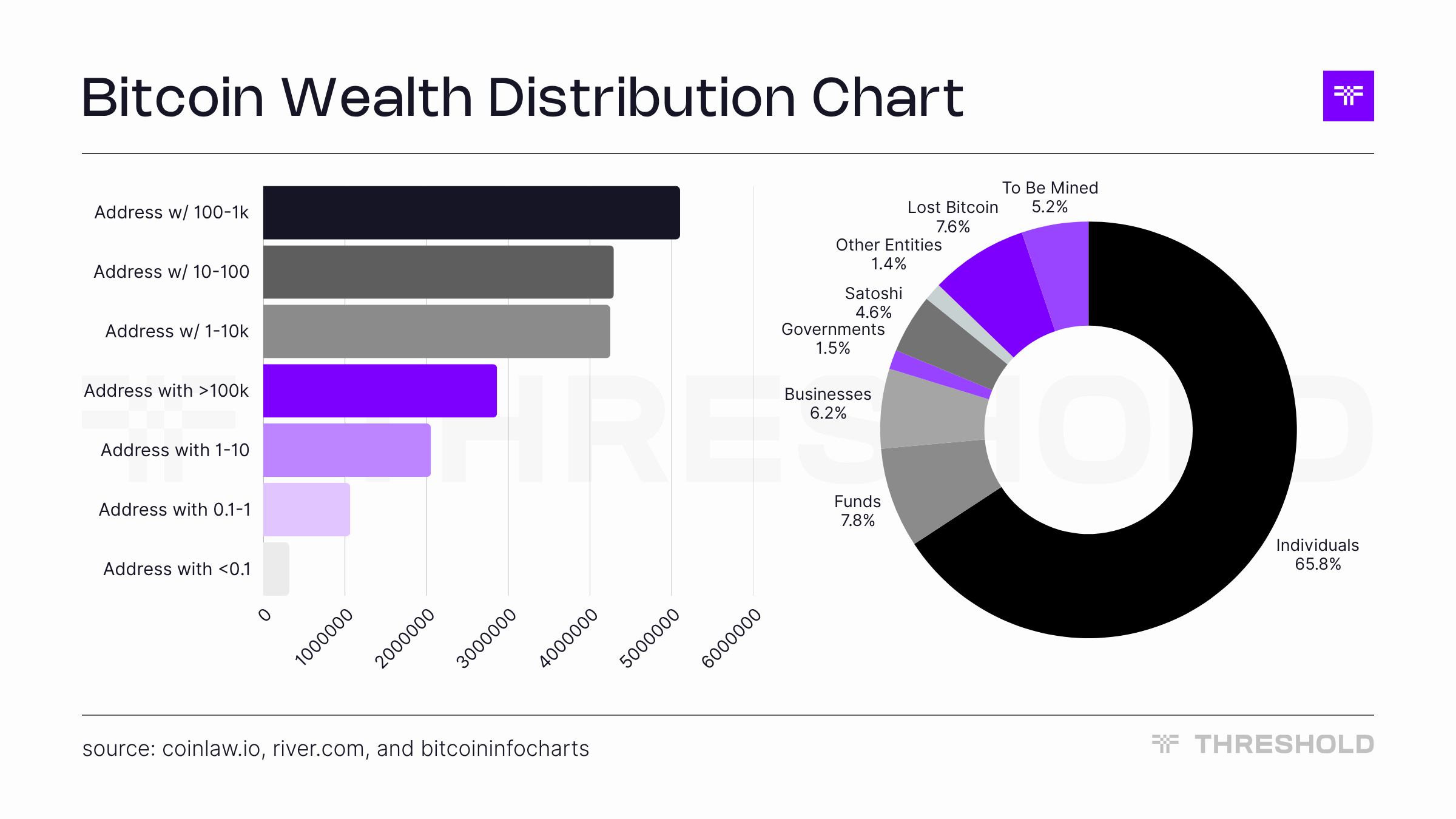

To put things in perspective, the structure of Bitcoin ownership has changed. A high-net-worth circle has formed within Bitcoin, with 157,000 addresses holding over $1 million and 19,142 addresses holding more than $10 million, representing roughly $500 billion in value. This concentration of capital has grown rapidly since the approval of U.S. spot Bitcoin ETFs in 2024.

Although individuals still control around 66% of Bitcoin’s supply, the influx of wealthier holders and institutions has accelerated over the past two years. Institutional holdings reached $414 billion by August 2025, fueled by ETF inflows and corporate treasury diversification. Corporate reserves climbed 40% in Q3 to $117 billion, while 172 public companies now collectively hold over 1 million BTC.

This consolidation signals growing institutional confidence in Bitcoin and a maturing financial structure that prioritizes security, transparency, and infrastructure designed to scale; the same foundation that tBTC builds upon to move Bitcoin seamlessly across decentralized markets.

Bringing Bitcoin’s Integrity to Scale, with tBTC

Considering these new metrics, Threshold Network has analyzed the data and is doubling down on its efforts to reach the expanding Bitcoin market by hyperfocusing on scaling tBTC.

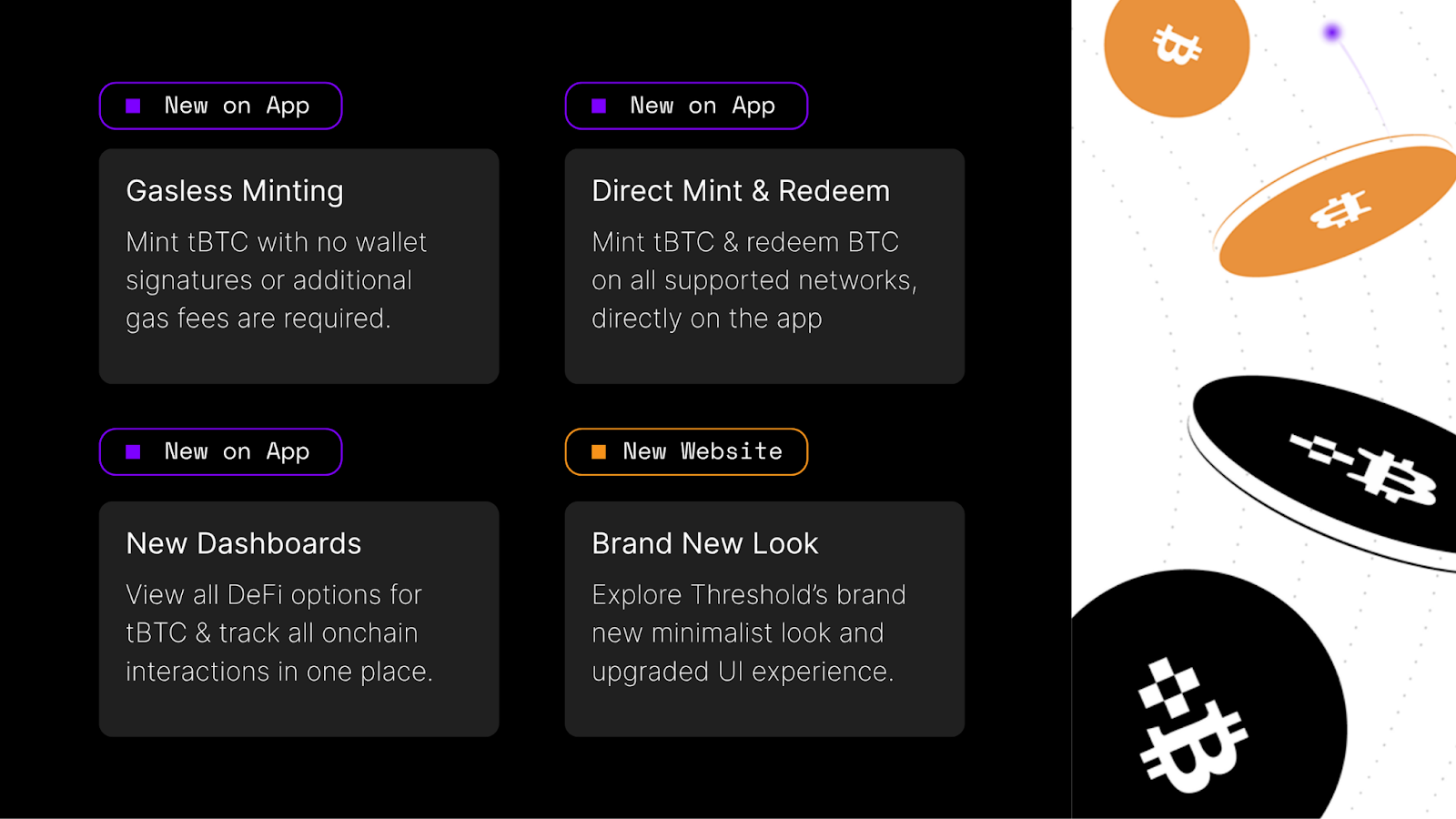

The new Threshold Network website is designed with clarity and purpose, reflecting our broader role in decentralized Bitcoin onchain markets. More than a bridge, it represents the next phase of Bitcoin's utility, providing a secure space for users to engage in DeFi while maintaining full ownership of their Bitcoin.

“The scale of institutional adoption since ETF approvals has been extraordinary,” said MacLane Wilkison, Co-Founder and CEO of Threshold Labs.

“Our focus is on building infrastructure that enables institutions, funds, and corporates to interact with Bitcoin onchain securely. As traditional finance integrates Bitcoin into its portfolios, tBTC stands as the bridge that ensures this participation remains decentralized, secure, and transparent.”

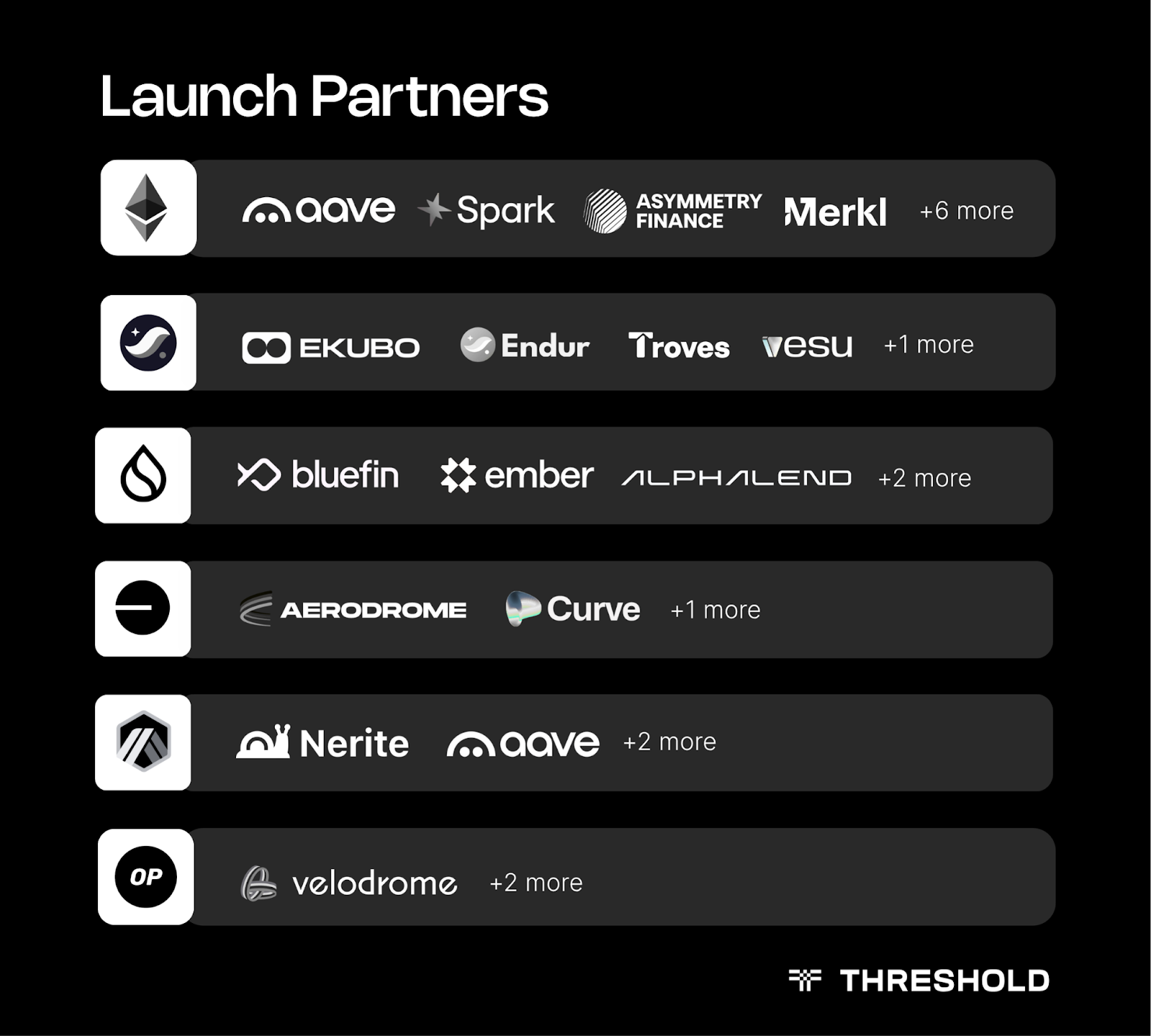

In parallel with this institutional rebrand, Threshold Network has spent the past several months expanding tBTC’s utility across leading DeFi markets, with interoperability powered by Wormhole. This includes partnerships with established protocols such as Aave, Morpho, Curve, and Aerodrome, as well as continued expansion into emerging ecosystems like Sui and Starknet.

These recent integrations have introduced a wider range of opportunities for tBTC holders. Enabling users to stake tBTC on Endur (supported by Troves), access lending markets such as Alphalend, Vesu, Sparklend, and Aave V3, or use tBTC as collateral on platforms including Nerite, Bucket, and Asymmetry Finance. Additional use cases include incentivized liquidity pools on Bluefin, Merkl, and Ekubo, as well as advanced yield strategies on Ember Protocol.

The New Threshold App: Built for Precision and Simplicity

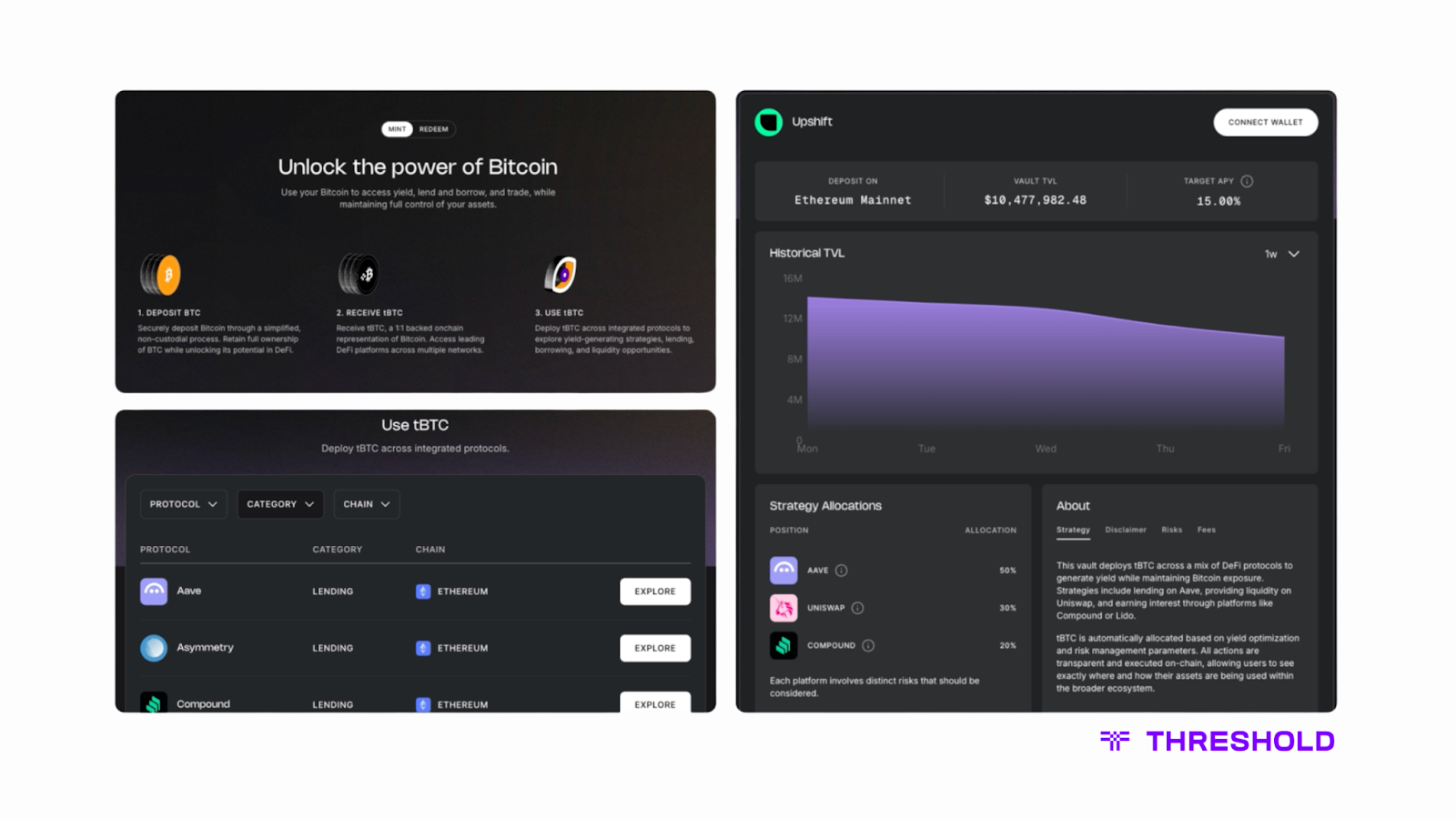

Alongside the website repositioning, we are launching a series of significant upgrades on the tBTC app. The goal was to make the movement between Bitcoin and DeFi markets both seamless and secure. Institutions need efficiency and reliability; individual users want simplicity and trust. The new app delivers both.

Users can now mint tBTC directly to supported chains, including Ethereum, Layer 2s, and non-EVM networks, all with a single transaction. In summary, the new features include:

- Direct minting to supported chains enables capital to flow efficiently into DeFi markets, allowing institutions to deploy Bitcoin liquidity across multiple ecosystems without relying on centralized intermediaries.

- Direct redemption to Bitcoin mainnet gives users confidence that they can always return to native Bitcoin, maintaining trust and liquidity across all use cases.

- No Layer 2 signing required means that even complex transactions can be completed with a single Bitcoin transfer, reducing operational overhead for institutional treasuries and simplifying onboarding for individual users.

The new app also introduces an improved dashboard experience designed for greater efficiency and visibility. Users can now get a bird’s-eye view of all available tBTC opportunities while effortlessly tracking their past onchain activity. These key upgrades include:

- Use tBTC: A new section built to help users discover where they can deploy tBTC or put their Bitcoin to work. It provides a comprehensive overview of tBTC integrations across multiple DeFi protocols.

- Vaults: a new dashboard that consolidates integrated tBTC vault strategies into a single interface. It allows users to access curated, externally managed vault strategies built for ease of use.

- My Activity: This section offers a unified record of all user actions across minting, redeeming, and vault participation. Every transaction is logged onchain, allowing users to easily track their history and monitor performance over time.

Gasless Minting on Supported Networks

Gasless minting is now possible on supported networks. Users only need to deposit Bitcoin; no wallet signatures or additional gas fees are required. They simply connect their wallet, send Bitcoin to a single-use address, and receive tBTC on their chosen chain. This feature allows both institutions and individuals to utilize Bitcoin capital efficiently without compromising custody or cost.

“This is a major protocol upgrade that represents Threshold’s maturity as a network,” said Callan Sarre, Co-Founder and CPO of Threshold Labs.

“We’ve rebuilt the app to give users a unified experience. Mint, redeem, and deploy Bitcoin faster, with confidence and transparency. The new interface delivers what users have consistently asked for: clarity and control without compromise.”

Building the Next Chapter of Bitcoin

One of the most deliberate decisions in this strategic refocus was how we defined the relationship between the website and the app. Both serve the same mission but tell the story in different ways.

The new website was created to meet the growing interest from institutional participants, a place where funds, corporates, and partners can understand how tBTC fits into modern financial markets. It is designed for transparency, education, and global scale, communicating in the language of capital while staying true to Bitcoin’s decentralized values.

The app delivers enhanced functionality without compromising on trust or simplicity. Tailored for Bitcoin holders, it offers a seamless, self-custodial experience for confidently managing and moving Bitcoin onchain.

“Our goal with this upgrade and renewed focus was to bridge institutional credibility with the authenticity of our original community,” said Rizza Carla Ramos, Head of Marketing at Threshold Labs.

“The website was developed to speak to a more mature audience, while the app keeps the experience familiar for long-term Bitcoin holders. Both are essential: one represents growth, and the other preserves who we are.”

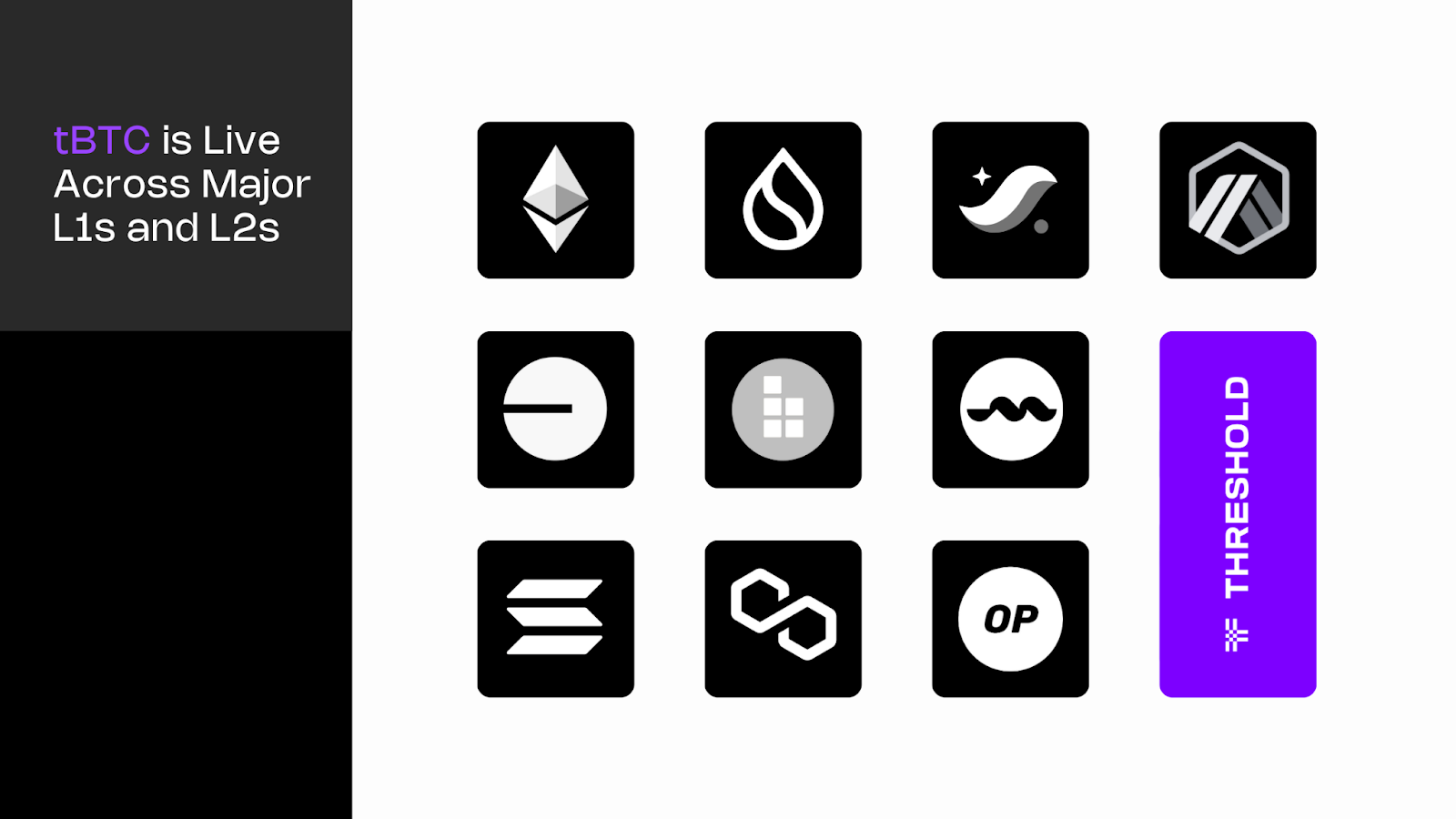

Today, tBTC is live across major ecosystems and networks, including Ethereum, Arbitrum, Base, Polygon, Sui, Starknet, BOB, and Optimism, expanding liquidity and access for both institutional and retail users. Each integration reinforces Threshold’s position as the infrastructure layer for Bitcoin onchain.

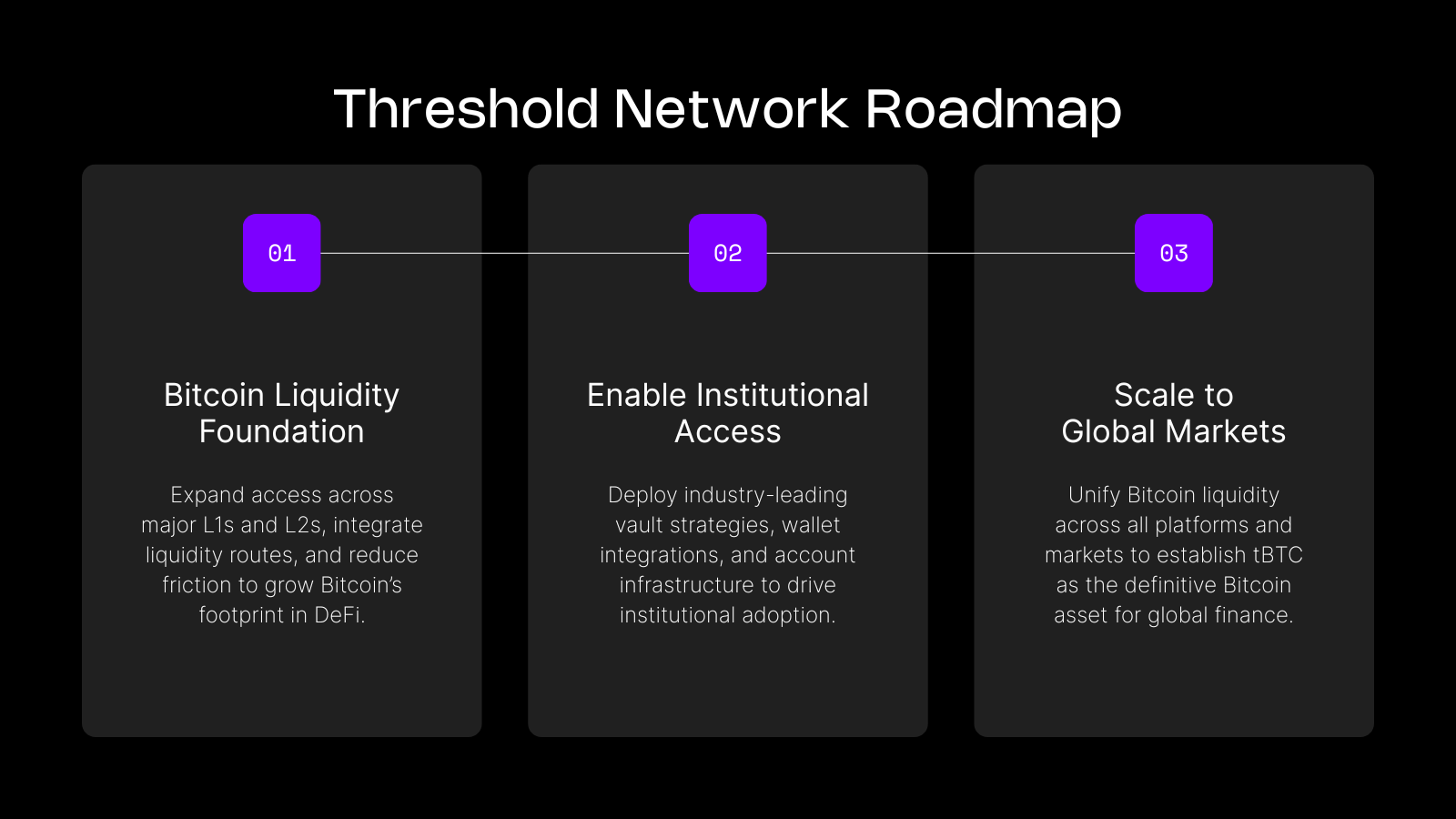

Threshold’s next chapter is focused on scaling tBTC through three phases:

This update is more than a design milestone; it marks the beginning of a broader mission. Threshold Network is building the infrastructure to connect institutional finance with decentralized markets, ensuring that Bitcoin remains secure, usable, and accessible for generations to come.

Bitcoin remains the foundation. Threshold builds its future.

Explore the updated Threshold website and Decentralized App